As we tell the story below, we think that you will enjoy matching wits against the negotiation challenges faced by our client . . .as well as assessing the moves we advised. We think you’ll also value a few broader lessons this episode holds for sophisticated negotiators; we summarize these takeaways at the end.

Case Study: The CHIP v. MONO Procurement Negotiation Challenge

Executives from our client, call it Computer High-Information Processing (CHIP), Inc., came to us with a challenging negotiation. Here’s how they summarized their predicament: CHIP is a leading company in the capital equipment industry struggling with rising supply chain costs. A supplier, which we’ll call “Made On No Other (MONO),” Inc is a quasi-monopolist – it essentially has a monopoly on a particular critical component, CELL, and has used that near-exclusive position to raise CHIP’s costs significantly faster than the rate of inflation. Overmarket Wealth Network (OWN), a private equity (PE) firm, had purchased MONO seven years ago. MONO uses a combination of design and market power to force bundling CELL with other components made by MONO, thereby increasing costs not only for CELL, but for other components that MONO sells to CHIP. Customer demand for CHIP’s products has been declining due to CHIP’s costs and prices increasing faster than the rate of inflation.

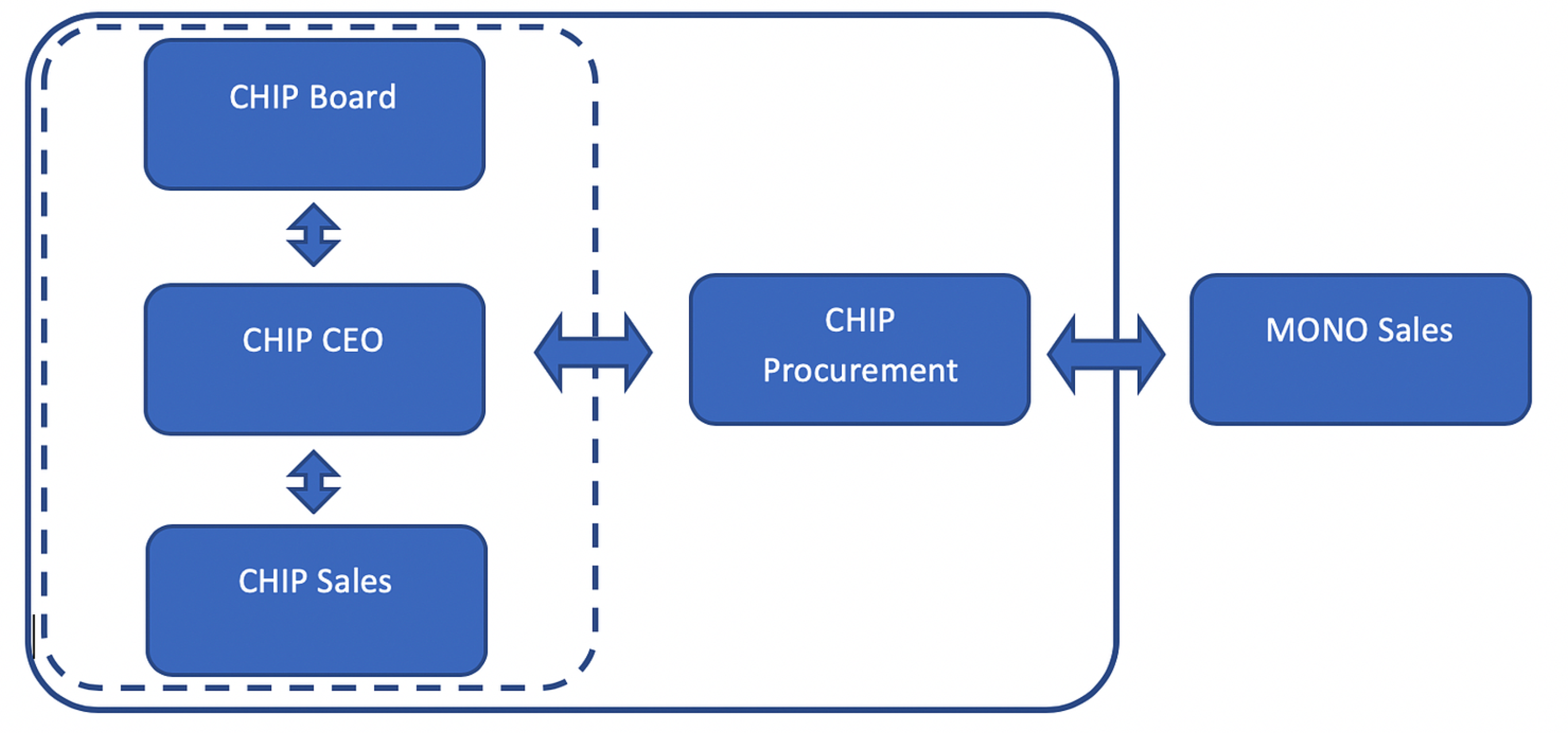

The Specific Challenge. Here’s the essence of the negotiation on which CHIP initially sought our advice. Its procurement group has not had much success to date negotiating with MONO’s sales team. The contentious negotiations threaten to disrupt CHIP’s service to customers and often end up in the media. Board members sensitive to press reports of instability lobby the CEO to change course and “go easier” on MONO. Additionally, CHIP’s sales team reports difficulty with key customers who are worried about product availability given the uncertainty about CELL’s availability. Faced with board and sales team pressure, the CEO urges the procurement group to be more forthcoming with its MONO counterpart. The resulting CELL and other component cost increases diminish demand for CHIP’s products year over year. Given this initial explanation of the situation, we asked CHIP to describe the party map, as seen by its procurement team, which is illustrated in Figure 1 below.

Other CHIP business units were unhappy with the results of the procurement team’s ongoing results, which come to a head each quarter. CHIP’s procurement group team faces these vexing challenges and was pondering how to handle this frustrating situation both internally and externally.

Aside: you might enjoy thinking through how you would advise CHIP on this situation. Then you can see the approach we began to develop for CHIP to implement.

A 3D Barriers Audit. We routinely advise doing a “3D barriers audit” of the deal set-up, design, and tactics in order to assess the obstacles that stand between a negotiator and his or her target deal. In CHIP’s case, such an audit made it quite clear that the most critical barriers were not interpersonal or tactical (such as communication, trust, hardball moves, cross-cultural issues, etc.). Instead, the negotiations suffered from a poor setup and flawed deal design.

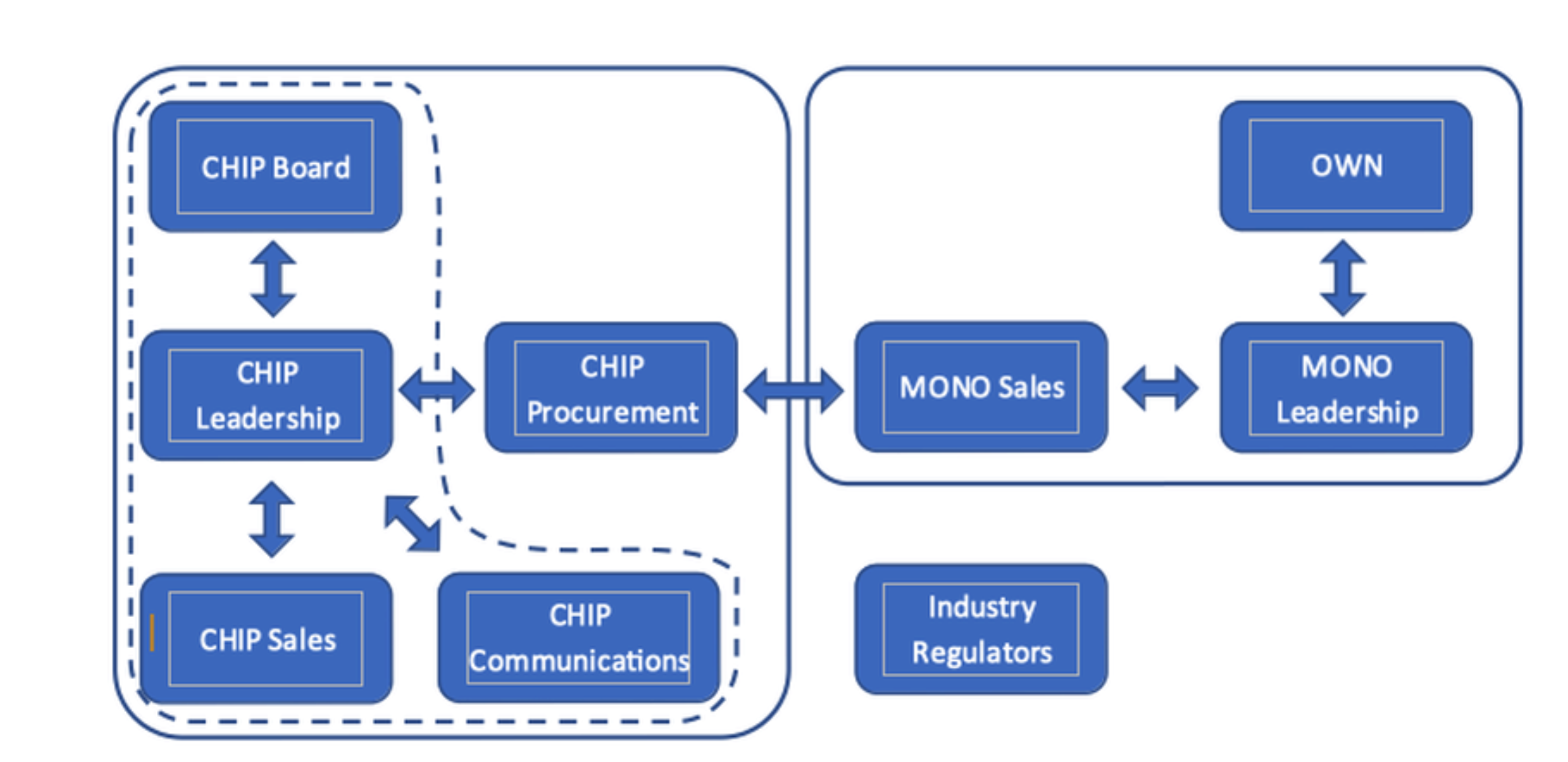

As Figure 1 illustrates, CHIP’s procurement group saw the negotiation as mainly taking place between it and MONO’s sales team. We urged the group to think more broadly and enlarge the party map to include the full set of influential players, including CHIP, MONO, and relevant third parties. Inside CHIP, the resulting map included the sales team, communications team, procurement team, key executives, the CEO, and the board. These were some of the obvious players, but we always counsel clients to look further for parties that might be influential in securing or blocking a deal. In this case, after pressing the CHIP executives, it became clear that MONO’s leadership should be added to the map, as well as Overmarket Wealth Network (OWN), the private equity (PE) firm that had purchased MONO seven years ago.

We also learned that complaints by CHIP and its competitors had opened an ongoing antitrust inquiry that has resulted in a preliminary report finding: a small number of this industry’s crucial component suppliers, including MONO, were using their quasi-monopoly positions to earn returns in excess of 20% above their cost of capital. CHIP is both the biggest player in its industry and the single biggest contributor to each supplier’s profits in this industry. The ongoing antitrust investigation has not reached a final judgement.

In addition to the more granular set of CHIP and MONO players, we urged that antitrust and other regulators should be added to the map. This expanded party map in Figure 2 offers a fuller and more accurate picture of the negotiation.

Two implications of this internal dynamic became obvious to us: First, negotiating success with MONO would inevitably lead to complaints from board members, leaks to the press about difficult negotiations, and perceived market instability. Second, without significantly reducing the rate of cost increases, demand from CHIP’s customers would continue to decline and CHIP’s core business would risk a worsening death spiral. Far from a simple price dispute with a supplier, CHIP faced a critical strategic choice: unless it was prepared to bend the cost curve, its only real choice was between slow death and fast death.

Armed with this analysis, we counseled CHIP’s CEO to strongly urge the board and sales team leadership not to interfere with the procurement team’s negotiations. As a result, the CEO instructed those board members who had supplier relationships with MONO and others to suggest that suppliers who complained should deal directly with CHIP’s procurement team. He emphasized that attempts to intervene in the negotiation between CHIP’s procurement team and MONO’s sales team would undercut a clear and agreed overall negotiation firm-wide strategy. Along with this strong message “from above,” CHIP’s procurement team coordinated with the firm’s sales team, laying out its planned negotiating approach to MONO. The CEO underscored that negative external press and market fluctuations were to be expected and would be part of executing a superior negotiation strategy. Hence, he would not be open to, and would even be hostile to, complaints that the procurement team’s negotiation strategy was hurting CHIP.

Understanding MONO’s Situation. Upon examining the full set of MONO’s interests—not merely how they say the procurement pricing results with CHIP—we focused on their larger situation. It is clear that PE firms such as OWN typically seek to exit their investments in 5-7 years. Therefore, OWN would likely attempt to exit soon, most likely to other PE buyers or through an IPO. Since its initial investment, the PE firm had not been able to extract meaningful fees from MONO, so its financial return would be a function primarily of its exit. Looking beyond the simple procurement deal, we were able to learn from financial industry contacts that OWN was currently trying to sell MONO to other PE firms that were attracted to MONO’s quasi-monopolistic status and its forecast of reliably increasing revenues.

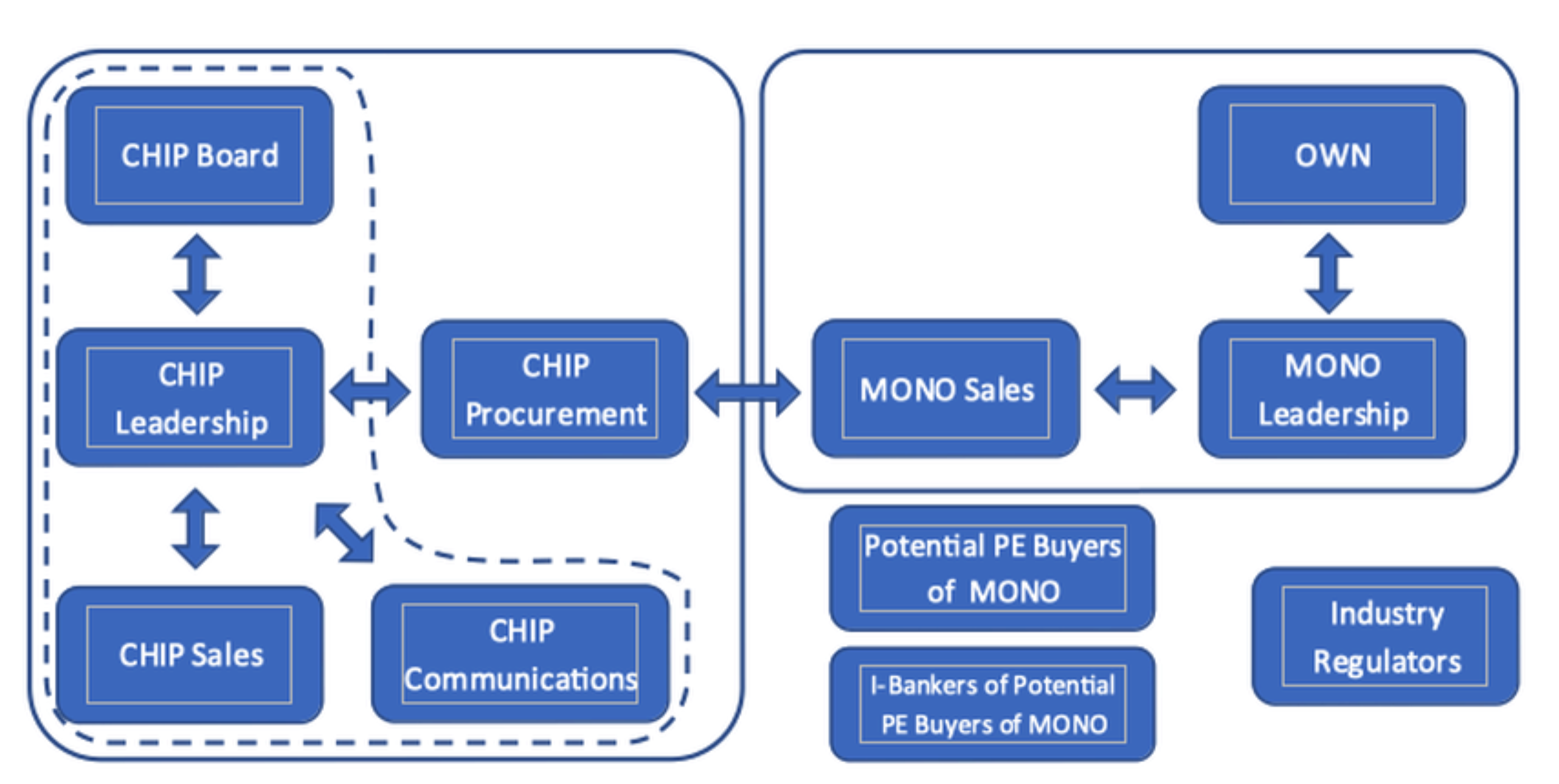

Developing Leverage with MONO via OWN: With OWN’s likely desire to exit from MONO in mind, we saw a point of potentially powerful leverage if CHIP could lower the economic expectations of potential buyers of MONO about the prices MONO would receive in upcoming negotiations with CHIP. In this case, OWN would then receive reduced offers for MONO if prospective buyers lowered its price and growth projections in their valuations.

Knowing OWN’s interest in having MONO’s financial situation look good to potential buyers, we counseled CHIP’s procurement team to press hard for a significant cost reduction and to be unyielding. MONO could have followed its traditional playbook and played hardball with CHIP, but to do so would have led to an impasse, raising uncertainty and damaging MONO’s prospects in the eyes of potential buyers. To prevent this, we expected—correctly—that OWN would be drawn into the process to force moderation on MONO.

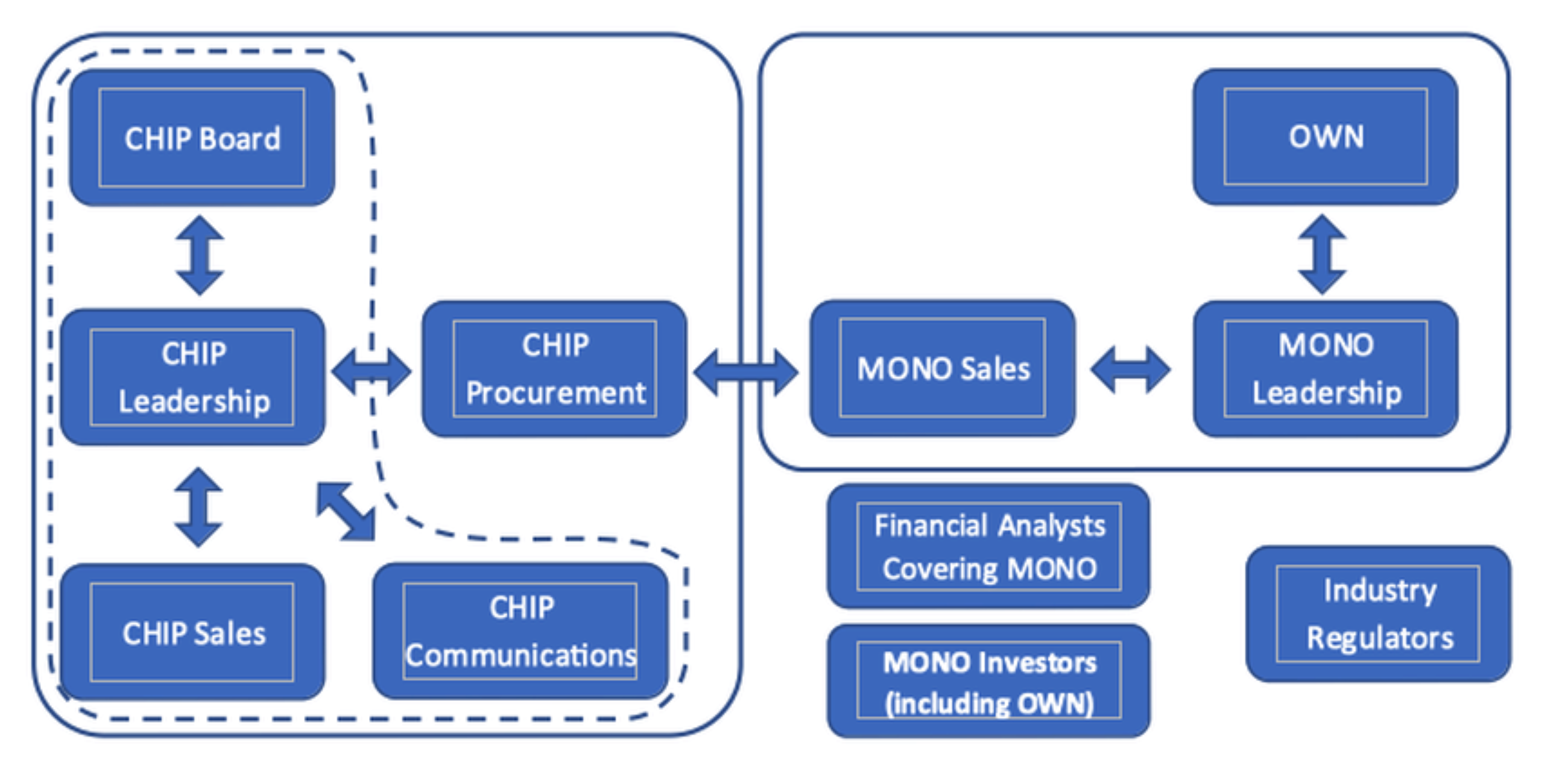

To CHIP’s executives, moreover, we underscored that MONO would work to meet new owner’s post-purchase business plan, and the new owners would be more likely to be anchored to price expectations developed before purchasing MONO. Shaping such price expectations thus became a core objective our CHIP’s strategy. Thus, it became appropriate to add financial analysts covering MONO to the party map and focus on influencing how they saw MONO’s future situation.

Knowing that OWN was shopping MONO, we suggested to CHIP’s executives that it approach MONO’s bankers indicating that CHIP executives would be happy to sit down with any interested parties to discuss what kinds of assumptions (lower!) should go into their revenue forecasts. We sniffed around to figure out other potential buyers of MONO and had CHIP approach their bankers as well. Figure 3 adds both potential PE buyers of MONO and their bankers to the party map. As we expected, all the bankers turned down such meetings. But these proposed meetings powerfully signaled to the potential buyers that they should be thinking about different—lower—revenue assumptions for MONO going forward.

A “Surround Sound” Approach. We suggested a kind of “surround sound” approach to this process. Further, prior to the proposed meetings with bankers, CHIP’s CEO used a scheduled discussion with the financial press to emphasize that a) antitrust authorities had made a preliminary finding that suppliers including MONO were using monopoly positions to make roughly 20% excess profits, b) CHIP thus expected to get a 20% cost reduction from those large suppliers, and that c) future price increases would be below the rate of inflation. Additionally, CHIP’s CEO emphasized that cost reductions received from suppliers like MONO would be passed on to CHIP’s customers in order to drive up demand. Every article about MONO thereafter mentioned that its largest customer, CHIP, was expecting a 20% price reduction. Downward pressure in MONO’s expected future earnings and anticipated negotiation uncertainty sharply reduced—and ultimately eliminated—interest from other PE firms in acquiring MONO.

Since it could no longer sell MONO to another single PE firm, OWN then announced an interest in an initial public offering (IPO) of MONO shares. CHIP met with MONO and delivered an outline of CHIP’s pricing objectives before substantive negotiations began between CHIP’s procurement team and MONO’s sales team. OWN proceeded with an IPO of MONO, which it completed but the resulting share price was not high enough for OWN to exit its position and earn an acceptable return. In the judgment of financial analysts and potential investors, MONO’s economic prospects had been too uncertain for a successful IPO in part due to its impending price negotiations with CHIP. CHIP’s executives used industry conferences and interviews to publicly endorse aggressive pricing goals. Figure 4 expands the party map to include post-IPO players. Managers working on CHIP’s procurement team, no longer overruled by their senior management, worked tooth and nail to deliver cost reductions in combination with a more mutually beneficial deal design (discussed below).

- After specifying a provisional target deal, carefully analyze the barriers that stand between you and the desired outcome. It would have been all too easy to assume that the negotiations with MONO had been stymied by faulty tactics or interpersonal issues of trust, communication, or stubborn insistence by the other side. Yet a deeper 3D barriers audit suggested that both the setup, which emphasized the bilateral CHIP-MONO talks, and the deal design, which focused almost entirely on price, were major contributors to the unsatisfactory situation.

- Map the Full Set of Parties, Their Interests, BATNAs, and Relationships. Negotiators often fail to examine the full set of parties, including their interests, BATNAs, and relationships with other parties. The “full set” of parties should take account of internal, external, actual, and potential players who might matter to the negotiation. Initially, CHIP saw the negotiation as primarily between its procurement team and MONO. Including other actual and potential parties who may be affected by and could influence the negotiations was critical to the strategy; in this case, a broader list of such parties would include CHIP’s leadership, OWN, the press, potential PE buyers of MONO and their bankers, financial analysts, institutional investors and industry regulators. Thinking carefully about those parties can lead to a completely different negotiation strategy. In this case, looking at the ownership of MONO and updating the map with new stakeholders throughout the process was critical to the positive outcome of the negotiation.

- Manage the Internal Negotiations. Don’t neglect to align your team with your objectives. To emphasize the prior point, negotiators should probe and map internal negotiations, both for one’s own side and for the other parties as well. Your counterparty is not likely to be a narrowly focused monolith. In this case, both CHIP’s internal negotiations as well as the relationship between MONO and OWN were essential to consider. Successful internal negotiation prevented CHIP’s procurement team from being undercut by CHIP’s board members and sales group.

- Looking Beyond the Immediate “Table” for Sources of Influence and Leverage. In this case, for leverage on the narrow procurement deal, we focused on tactical moves to reduce the PE owner’s prospects for selling its portfolio company at a price that assumed that MONO would continue its quasi-monopolistic pricing with CHIP. Because MONO’s PE owner was seeking an exit, CHIP’s messaging of its expectations for the downward trajectory of costs and the potential price volatility that no-agreement would create worsened the economic expectations of potential PE buyers for MONO. As such, these announcements reduced OWN’s prospects for a profitable sale of MONO to another PE firm. Together with a more unified approach throughout CHIP to the procurement talks, a good deal became possible.

- Seek Joint Gains In What Might Appear To Be Pure Price Deals. A consistent theme of our work is to transform what appear to be pure win-lose price deals into more creative agreements that provide greater value to all sides. By delivering stability and a long-term constructive path, CHIP was able to reduce the downside volatility in MONO’s valuation from the standpoint of the analysts. CHIP thus met an important need for MONO’s PE owner and received, in return, an attractive cost decrease and trajectory that positioned both companies well for the future.